An Uncertain Bull Market

Ă‚Â This is an unbelievably good market one may say, as of May 16, the S&P 500 is up 3.3% for the month and over 15.7% for the year. Just look at the numbers, the S&P 500 had six consecutive positive months and only four negative months for the past nineteen months going back to October 2011. If we continue at this rate the S&P 500 might be touching 2,000 mark …

Comments

Don’t get burned by Energy

This year was not kind to investors investing in the energy sector. The sector is the worst performing sector year to date, as measured by the Energy Select Sector SPDR (XLE) from State Street, with negative 7.43% for the year and severely underperforming the S&P 500 ETF (“SPY”) by 14.79%. Sector Ticker YTD Return YTD over SPY Technology XLK 12.70% 5.34% Discretionary XLY 11.74% 4.38% Financials XLF 11.12% 3.76% Healthcare …

Comments

by Rosalyn Retkwa

Will This Be the Year of the Actively Managed ETF? By Rosalyn Retkwa

Managers are gearing up for new fund launches but demand remains uncertain and front-running fears are still an issue. Jack Brennan, chairman emeritus of The Vanguard Group, known for its low-cost index funds, recently echoed a common sentiment when he described actively managed ETFs as an oxymoron. “One of the reasons you index is to take manager risk out of the equation. To put manager risk back into the equation …

Comments

by Tom Lydon

Active vs. Passive Debate Spills Into ETFs By Tom Lydon

Actively Managed ETFs News: The debate over active management versus passive management remains, but in the end does it really matter? Both styles compliment exchange traded fund investing and when used together — they can both enhance a portfolio. “While some trace their history to as early as 2000, most were launched in just the last five years. Looking at the market size, the Morningstar managed ETF database puts total …

Comments

by Brendan Conway

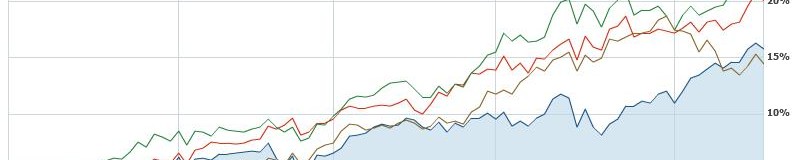

Time To Buy an Active ETF? Stock Pickers Doing Well in 2013 By Brendan Conway

We often note the paucity of actively managed exchange-traded funds — often enough, apparently, that BlackRock’s (BLK) Larry Fink cited a line from a recent column on the company’s earnings call pooh-poohing their progress last year: “Actively managed ETFs may be the biggest story that never quite happened in 2012.” And yet the small number of actively managed ETF are doing remarkably well. At least, several are starting off 2013 …

Comments

by Jason Kephart

Growth Spurt: Active ETFs on the way to $500 billion By Jason Kephart

McKinsey says name brands will drive big growth over next seven years Actively managed exchange-traded funds have yet to take off with investors — with one big exception — but over the next several years, experts expect them to grow faster than their passive brethren. Ă‚Â Pooneh Baghai, co-leader of the Americas wealth management, asset management and retirement practice at McKinsey & Co., predicts that assets in actively managed exchange-traded …

Comments