Market Vs. Economic Cycles And Sector Rotation – Seeking Alpha

Market Vs. Economic Cycles And Sector Rotation – Seeking Alpha.

By Lance Roberts

“To Everything (Turn, Turn, Turn)

There Is A Season (Turn, Turn, Turn)

And A Time To Every Purpose, Under HeavenA Time To Be Born, A Time To Die

A Time To Plan, A Time To Reap

A Time To Kill, A Time To Heal

A Time To Laugh, A Time To Weap”

Those lyrics to Turn! Turn! Turn! by the Byrds were originally adapted from the book of Ecclesiastes in the Bible. While the song discusses the “seasons” of life it is just as applicable in regard to the economy and the markets. There is a cycle to all things big and small and the key to long term success in investing is understanding the difference between the “seasons” in the markets and the economy.

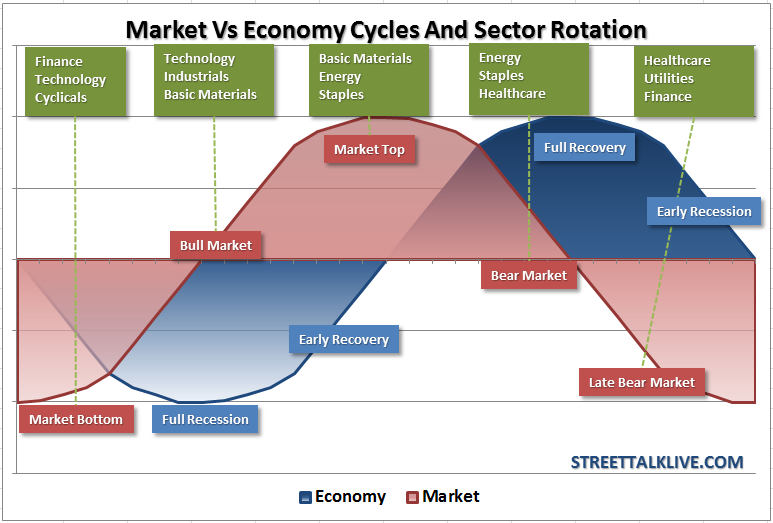

The chart above is an overlay of the economic cycle and the market cycle. The market cycle has been shifted ahead by about six months as it has historically tended to lead the economic cycle. This is a generalization, of course, and this time could certainly be different. However, if we use history as a guide we should be at least able to garner some clues about where we are in the current market and economic “seasons.”

In the chart I have also identified the sectors of the market that generally tend to exhibit the best performance during each cycle.

Important note: By using the term “performance” I am not implying that during a negative market cycle that those particular sectors will go up in value. It does mean, however, that they tend to decline less than the overall market during negative market trends. This is extremely important to understand as investors tend to react emotionally to market losses and dump holdings indiscriminately during market sell offs. Building a defensive portfolio that is 100% invested in stocks is still going to decline with the market. This is why we advocate holding larger than normal pools of cash during market declines as it reduces portfolio volatility and emotionally based decisions which can negatively impact long-only portfolios most commonly found among individual investors.

So, how do you tell when there is a seasonal change? In life it is fairly easy. The retail outlets pretty much tell you a change is coming by swapping out their inventories and having seasonal clearance sells. Or, you could still make a pretty good guess that summer was ending and fall was approaching due to cooler temperatures, leaves turning colors and days getting shorter. The markets, like the weather, can also provide clues as to the season of the economy.

Winter

As the economy heads into the depths of a recessionary cycle the markets generally begin their bottoming process in anticipation of a recovery coming in the not too distant future. During this bottoming process finance, technology and cyclical stocks tend to perform better as the market starts anticipating the areas that will most benefit from the thawing of an economic winter.

Spring

As the economy begins to thaw and the “green shoots” of a recovery start to show, the markets begin to shift into a full-fledged cyclical bull market. Money flows now shift from finance and cyclical related industries to the areas that are benefiting the most from the economic recovery such as industrials and basic materials and continues to include technology.

Summer

As the spring warms to a full recovery as the economic recovery heats up and becomes more mature, the markets began to shift to recognize that all good things must come to an end. Now the markets shift their focus from early economic recovery beneficiaries to areas that are benefit from a peaking of economic growth such as energy and staples and early defensive movements into healthcare.

Fall

Finally, as the economic summer begins to fade, the bloom falls off the market as it moves into the later stages of the bear market. At this juncture money moves into the areas that are the most “defensive” from economic drags. Regardless of what happens in the economy, consumers will still have to pay for healthcare and utilities. Finance, technology and the areas most economically sensitive at this point are being hit hard as expectations adjust for a shortfall in earnings potential and potential overvaluations are brought back into line. As the fall season of the market begins to shift toward full winter, money begins to look toward to the finance sector as an early beneficiary to end of the economic downturn and the inevitable repeat of the market life cycle.

Click to enlarge

Where Are We Today?

That is the question that we need to answer. There has been a lot of debate over where we are in the economic cycle. As you know we have been proponents of the fact that we are headed into a recession most likely by early 2012. However, if the market cycle is currently leading the economic cycle then what are we to learn from the current levels of performance from the underlying sectors?

According to the performance of nine sectors that make up our analysis over the last 200 days, the sectors that are leading the charge are the very ones that are normally indicative of a cyclical bull market peak: Energy, staples, healthcare and utilities. Historically, these have been the typical beneficiaries to money flows as markets and the economy migrate toward their current cycle peak. Therefore, this technically would put the markets into the “fall” season which would correspond with “market top” and “full recovery” in our first chart above and aligns with our analysis of current economic weakness going forward.

If that analysis is correct then the current market action is telling us that it is time to pack away the summer allocations and break out the winter coats to hunker down for what may be a chilly 2012.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Comments

Leave a Reply

You must be logged in to post a comment.