Emerging Market Sectors

Sectors are my friends; they should be your friends as well. Sector investing provides inherent diversification, eliminates individual company risk as well as better liquidity vs. individual names.

My firm, The Rockledge Group, focuses on investing in large cap US sectors, but I decided to take a look at emerging market sectors. If you look at the past three month performance you can see that a broad emerging market index, as measured by EEM, did quite well compared to our US broad market index as measured by S&P 500 index, with three month outperformance of almost 6%.

So how does one take advantage of this potential opportunity. You can of course just simply buy the EEM, instead of SPY. That gives you a broad market exposure. Instead I would favor a more focused approach by picking sectors.

I decided to look at the sector ETFs provided by Emerging Global Advisors, a company that focuses on emerging markets, but in a more precise ways than other emerging markets ETFs. For example they offer country ETFs that draw from the BRICS (Brazil, Russia, India, China and South Africa) and other emerging markets countries around the world. What’s interesting about these country ETFs is that they focus on exactly why you would enter a position in the emerging market in the first place and that is infrastructure growth of each individual country.

And this is very rational, as the major reason you go into an emerging country is your belief that the growth, both the population and economy, is higher than in the mature markets, such as the US or Europe. And no better way to do this is to have specific on growth and expansion of country’s infrastructure.

In addition to the ETFs focused on country specific infrastructure, they also offer emerging markets sector ETFs. Right now they have four sector ETFs that focus on Consumer, Energy, Financial and Metals and Mining sectors.

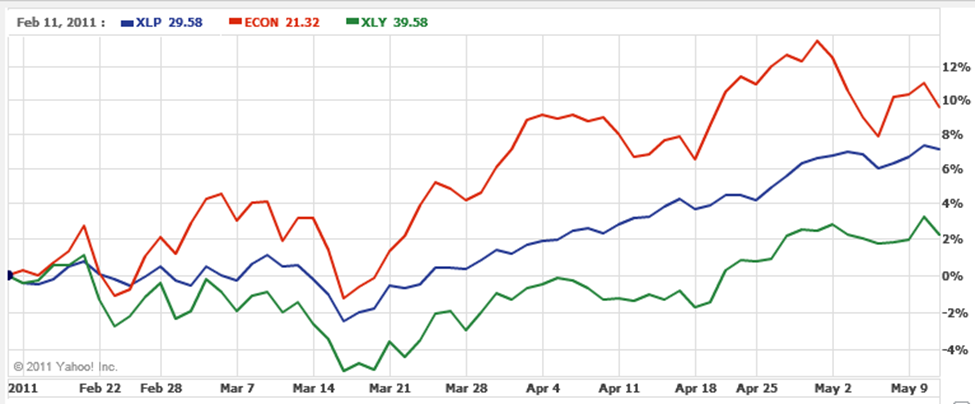

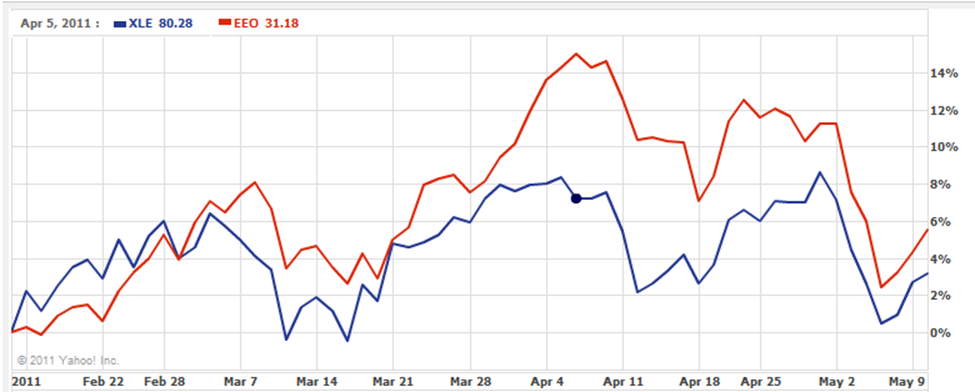

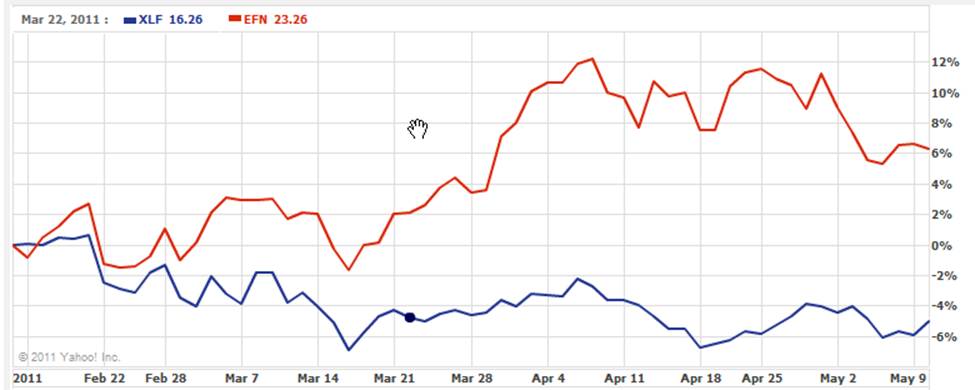

Here I decided to compare the performance of each of these emerging markets sector ETFs to their US counterparts. I compared emerging markets Consumer sector (ECON) with XLP and XLY. I compared emerging markets Energy sector (EEO) with XLE. I compared emerging markets Financials sector (EFN) with XLF.

All three have very different dynamics and reasons to grow, or not, but each one of these sectors certainly has a lot of movement and hence a lot of potential either to go long or short.

What struck me the most is that each individual emerging market sector ETF outperformed its US equivalent.

The Consumer sector ETF ECON, outperformed XLP by about 1.5%, and outperformed XLY by almost 8%.

The Energy sector ETF EEO, outperformed XLE by about 1.5%.

The Financial sector ETF EFN, outperformed XLF by almost 9%. In fact, while the US financial sector was strongly negative for the past three months, the emerging markets financial sector delivered a very strong performance.

Clearly all this is rational because we saw in the first graph that now is the time that emerging markets are outperforming mature markets. What was not so clear, but is in evidence with the consequent charts, is that each emerging markets industry sector can outdo its mature market industry sector even more so than the spread between broad emerging markets and mature markets indices. So pick emerging market sectors instead of broad markets and pick wisely.

Position disclaimer: Rockledge clients hold positions SPY, XLE, XLF, XLP, XLY

Comments

Leave a Reply

You must be logged in to post a comment.