2011 In Review

Last week I wrote about possible asset allocation for this year. This week I would like to review last year sector performance and remind that a prudent investor wants to have proper asset and sector allocation instead of picking individual stocks.

Last year was a year that we will not forget, the volatility was very high and correlations among asset classes increased dramatically. The S&P 500 was dead even for the year, you might have just closed shop for the entire year and come back on January 1st of 2012.

Overall the market did not trade on fundamentals, but on macro and political events, or as some people say that the market was not “rational”. To each its own “rationality”, but most of us do the homework and do analyze our investment picks and we do expect that basic fundamental analysis does work. But the market did not behave rationally and even hedge funds lost money in 2011. It is no wonder that a typical investor, even the one who did his homework, did not do so well.

Let’s look how the sectors performed for the year.

| Ticker | Sector | 2011 Return | Excess Return over SPY |

| XLU | Utilities |

19.7% |

17.8 % |

| XLP | Consumer Staples |

14.1% |

12.2% |

| XLV | Healthcare |

12.4% |

10.5% |

| XLY | Consumer Discretionary |

6.0% |

4.1% |

| XLE | Energy |

2.8% |

0.9% |

| XLK | Technology |

2.6% |

0.7% |

| XLI | Industrials |

-1.1% |

-3.0% |

| XLB | Materials |

-10.9% |

-12.8% |

| XLF | Financials |

-17.1% |

-19.0% |

| SPY | S&P 500 |

1.9% |

0.0% |

Source Rockledge

The top performing sectors were Utilities, Consumer Staples and Healthcare. These are clearly defensive sectors that outperform during sluggish economic and uncertain times, and 2011 was a good example of that. Although we usually speak of Asset Allocation, I would call last year’s sector performance as “Fear Allocation”.

So you should ask yourself, in this Fear market would you want to pick individual stocks? I would say absolutely not, as the political and economic environments was highly uncertain and correlations increased dramatically and stock picking was not a good investment approach in 2011. The more prudent approach would be to look to more diversified equity portfolio and focus on sectors.

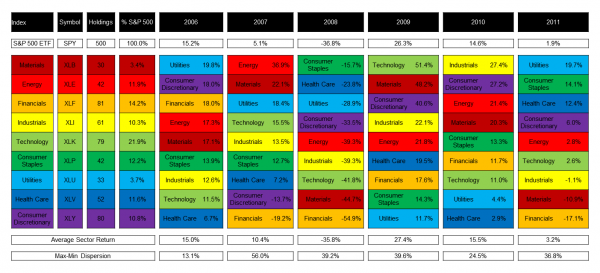

If you look at the past six years, it is pretty clear that each year brought its own market dynamics and being in the right sector was crucial to good performance.

Source Rockledge

What this chart tells is that each year the performance difference between the highest and lowest performing sector is typically very large. For the past five years this sector dispersion has varied from 24% to 56%.

It is also well documented that over 90% of an individual stock return can be attributed to the sector it is in. So if you were picking stocks in the lowest band of the sectors, it was virtually impossible for you to outperform or even come close to the S&P 500 benchmark and your portfolio would have disastrous (relative or absolute) results. On the other hand, if you would have picked pretty much any stock from the highest band of the sectors, you would have been an almost “automatic” winner every time.

My suggestion for improved risk adjusted equity returns is to focus on sectors first, based on the fundamental and macroeconomic analysis, and invest in these well diversified corresponding ETFs. For the more adventures investors, you can look within these sectors and drill further into Industry Groups or Industries or even Sub Industries to invest. For the highest investment risk profile investor, you would perform the above analysis and then potentially pick individual companies. Based on the past year and current year’s uncertain economic and market environment, staying with an appropriate sector investment thesis would be a more prudent choice.

__

At the time of publication Gurvich and Rockledge clients had long positions in XLB, XLF, XLK and short positions in XLE, XLI XLP, XLU, XLV, XLY.

Leave a Reply

You must be logged in to post a comment.