Trading Like the Hedge Funds Do

With the market starting the year quite well — S&P 500 was up 4% as of Wednesday’s close — we might be tempted to assume thatĂ‚Â Ă‚Â the rest of 2012 will go as smoothly, and start allocating higherĂ‚Â Ă‚Â percentage of our portfolios to U.S. equities. After the past year,Ă‚Â Ă‚Â which resulted in zero returns for the S&P 500, who can blame us?Ă‚Â Ă‚Â It’s also an election year, so things we may certainly feel things areĂ‚Â Ă‚Â looking rosy.

That might well be the case, but of course we will not know for sure till the end of the year. As for myself, I feel there are still too many macro unknowns left to be resolved, so I remain quite cautious.

With that in mind, I would like to suggest aĂ‚Â different tact thanĂ‚Â simply “increasing allocation to equities.” I amĂ‚Â talking aboutĂ‚Â alternative strategies in general, which can be pursuedĂ‚Â throughĂ‚Â alternative ETFs. I’m focusing on these, and notĂ‚Â on mutual funds, for aĂ‚Â few reasons: ETFs are transparent, they tradeĂ‚Â intraday, they provideĂ‚Â better liquidity, they have lower cost and theyĂ‚Â may provide taxĂ‚Â advantages.

As for alternative ETFs,Ă‚Â specifically, my major reason for startingĂ‚Â to look at these is that theyĂ‚Â provide prudent portfolioĂ‚Â diversification. As I have written before,Ă‚Â major endowment funds — atĂ‚Â such universities as Harvard and Yale — make room for alternativeĂ‚Â strategies among several other assetĂ‚Â classes (equities, fixed incomeĂ‚Â and real assets, such as commodities andĂ‚Â real estate). As of September,Ă‚Â in fact, Harvard’s endowment fund shows a 16%Ă‚Â allocation toĂ‚Â alternative assets, or absolute return.

What characterizes alternative assets is that they typically have low correlation to broad stock indices, and they aim to provide low volatility. They also make for an excellent portfolio-diversification tool, meaning that high-quality alternative-strategy funds provide for better risk-adjusted returns. In other words, to a large extent alternative funds will reduce your volatility, while only paring back on returns to a comparatively slight degree.

TheseĂ‚Â alternative strategies provide for low correlation and lowerĂ‚Â volatilityĂ‚Â because they use hedging techniques — just like hedge fundsĂ‚Â do. AĂ‚Â typical hedged approach, aptly named the long-short strategy,Ă‚Â willĂ‚Â involve simultaneous long and short exposure on certainĂ‚Â securities. SomeĂ‚Â of these aim to deliver alpha from both the long andĂ‚Â short positions,Ă‚Â while others aim to do so from long positions, whileĂ‚Â hedging with shortĂ‚Â positions.

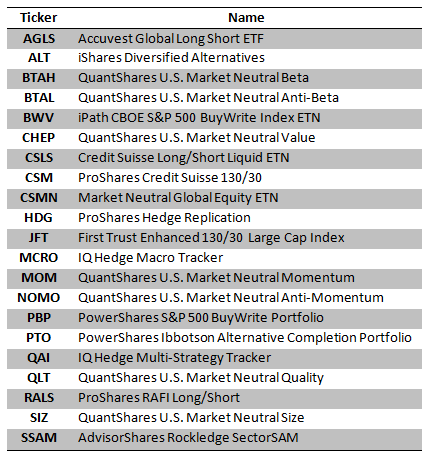

So, now — presuming you like the idea ofĂ‚Â diversifying yourĂ‚Â portfolio and reducing your risk — where do you findĂ‚Â more informationĂ‚Â about these ETFs? There are several good sources, but IĂ‚Â especially likeĂ‚Â ETFdb.com and IndexUniverse.com. In fact, I’ve usedĂ‚Â both to putĂ‚Â together a combination of alternative and long/short ETFs,Ă‚Â andĂ‚Â ultimately I came up with a list of 21 funds:

Long/Short ETFs

Source: ETFdp.com and IndexUniverse.com

This is my first cut, based on the criteria I have established above. Although a 21-name list might seem daunting, it is actually not a very long list, relative to other type of asset classes from the endowment category list.

In any case, with those choicesĂ‚Â established, the next step isĂ‚Â deciding which particular alternative ETFĂ‚Â to add. The criteria you useĂ‚Â could be limiting yourself to an equity or options ETF, or to one thatĂ‚Â Ă‚Â employs active management or follows an index. You could also pick aĂ‚Â fund that’s market-neutralĂ‚Â or dollar-neutral, one that’s factor-drivenĂ‚Â or goes on fundamentalĂ‚Â valuations, to name just a few options here.

Regardless of what you choose, though, I continue to strongly believe in prudent portfolio diversification by allocating to different asset classes. Adding alternative long/short ETFs will go a long way toward achieving that goal.

__

At the time of publication, Gurvich and clients of The Rockledge Group were long SSAM, of which Gurvich is the portfolio manager.

Comments

Leave a Reply

You must be logged in to post a comment.