A Dangerous Game

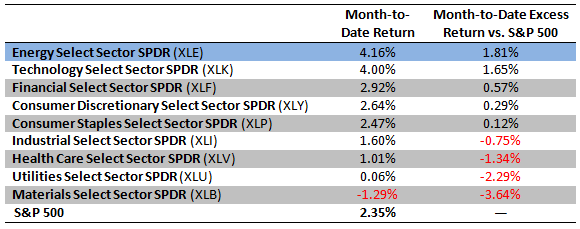

There’s no doubt about it: Energy is on the rise. The space, as measured by the Energy Select Sector SPDR (XLE), is this month’s best-performing sector. The fund has gained 4.2% as of Feb. 15, outperforming the S&P 500 by 1.8%.

That’s quite a difference from last month’s performance, when it was close to the bottom of the pile, underperforming S&P 500 by 2.1%.

Looking at these data, you might think the economy is having a robust pickup, with double-digit growth both in the U.S. and in emerging-markets countries such as China and India. One could even venture to say that the solid performance in the technology, financial and consumer discretionary sectors — as measured by Technology Select Sector SPDR (XLK), Financial Select Sector SPDR (XLF) and Consumer Discretionary Select Sector SPDR (XLY) is the sign of a growing economy and the beginning of a bull market. I would not be so fast to agree.

Let’s look into this further and determine whether this is an accurate analysis. First of all, the other sectors that usually do well in the growing economy are industrials and materials — and they are clearly not booming this month. In fact, the materials sector, as gauged through Materials Select Sector SPDR (XLB), has been a huge drag on the S&P 500 this month, with underperformance of 3.6%. Meanwhile, the industrials sector, via the Industrial Select Sector SPDR (XLI), is underperforming the S&P by 0.7%. Furthermore, the staples space — through the Consumer Staples Select Sector SPDR (XLP) — is hovering in positive excess-return category. That does not point to the “booming economy” scenario.

So, back to the original question: Why has the energy sector shown such robust performance this month? The answer is this: This isn’t being spurred by growing demand but, rather, by growing tensions in the Middle East.

Iran is playing a dangerous game of nuclear posturing (though, of course, we can’t know whether this is really just a game), and the U.S. and Western allies are putting a strong squeeze on the country. These actions seem to be finally making some headway. The Obama administration has made quite clear that it will not stand for a nuclear Iran, so the stakes are high, as the White House cannot look weak and indecisive during an election year. I am not big on conspiracy theories, but one that’s been floated of late is the “tail wagging the dog” theory — that is, the current administration might actually be looking for a conflict at this time.

But, back to how this affects the energy space — I hope we all remember what happened last year during the start of the Arab Spring. The tensions were high, with the West and the rest of the developing and energy-consuming countries highly uneasy of the potential outcome of these uprisings — as well as the potential effect on the oil supply in specific. At the height of the Arab Spring, in the first quarter, the energy sector — that is, XLE — climbed a whopping 17.2%, outperforming S&P 500 by 11.8%. The next-closest sector, industrials, was only 3% past the S&P 500, as measured by the XLI.

During the first quarter of last year it was virtually impossible to make any money, unless you were in the energy sector. So where does this leave us, the long-term investors?

Personally, I do believe neither the Iranians nor the U.S. want an actual military conflict. It would be too messy for both sides and too unpredictable, and it could easily spiral into something really bad. The Iranian regime knows that it would likely take heavy losses, while the U.S. is very afraid of an economic shock to the economy that would put the brakes on an already very slow recovery. But if one had an inclination toward this scenario, they would likely expect to see more posturing, more threats and more verbal escalation.

This does not bode well for the markets in general, because it means it’s not the actual events but, rather, the threat of the events, that will make the markets very jittery and volatile. If you are a risky investor who has the ability and desire to play this particular market scenario, it will be easy to take on more and more exposure to the energy sector — but you must have nerves of steel. For a longer-term investor — and I am putting myself into that category — I would allocate some position (perhaps 10% to 20%) of your portfolio to the energy sector as a hedge.

Let’s hope for the peaceful resolution to this conflict — but know this is something upon which we cannot rely.

Comments

Leave a Reply

You must be logged in to post a comment.