Choose Carefully Before Making a Permanent Move

This month Global X launched a new and unique product Permanent ETF (PERM). I would like to applaud the innovation of the product, but criticize its timidness.

First, the good. The product aims to provide an all-inclusive answer to investors who seek diversification and invest in many different asset classes, akin to what the endowments do. The endowments, such as Yale and Harvard, allocate their portfolios to different asset classes, such as Equities (domestic, international, emerging markets, private), Fixed Income (domestic, international, emerging markets, high yield), Real Assets (commodities, real estate) and Alternative Strategies.

There are many benefits to investing in all the asset classes listed above, such as diversifying your portfolio, reducing risk and decreasing portfolio correlation to the broad market indices. I am a big fan of this ‘Endowment Model’, because I believe that a wise investor should properly diversify his/her portfolio to earn the best risk-adjusted returns.

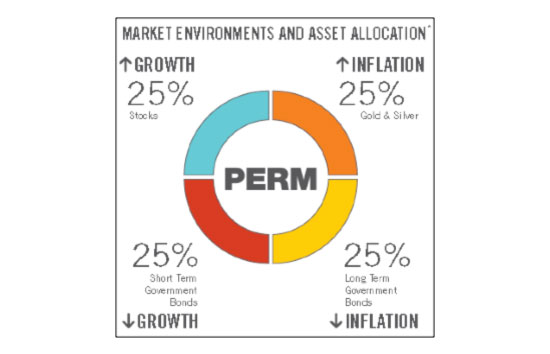

PERM aims to divide its holdings into four equal baskets: stocks, short-term bonds, long-term bonds and gold/silver. According to management, the reason for this is that markets are affected primarily by two factors, growth and inflation. Different asset classes provide better investment opportunities in different environments. For example, during a high-growth period, stocks outperform; conversely during periods of low growth, short-term bonds outperform. During periods of high inflation, gold and silver would do well, while during low-inflation periods, long-term bonds would outperform.

The investment philosophy is well represented in the diagram below.

PERM Investment Philosophy

Global X should be commended for the effort of creating PERM. During the past several years investors have been craving a steady, low-risk, diversified and non-correlated product — everything that the Endowments have been doing for years. In that sense, PERM provides what investors want in a liquid ETF wrapper.

Several ETFs have come to the market within the past year that focus on low beta or low volatility, but those ETFs are less useful than PERM, simply because a low beta or a low volatility product does not provide appropriate diversification and non-correlation as the Endowment model calls for. The downside of the low beta and low volatility products is that portfolio allocation to those products cannot be static, but dynamic. For an active sophisticated investor or hedge fund, that’s OK, because they focus on active management and their own ability (hopefully) to know when to be in low beta or high beta products or low volatility or high volatility product.

For a supporter of the Endowment Model, this fund is a beautiful thing, well mostly, not exactly so. I have several issues to discuss here.

First, for a fund that can truly be held on permanent basis, as PERM would like it to be, it is missing the most potent and most effective tool in the endowment model, which is an alternative asset class. Within the Endowment Model, it is the alternative asset class that is mostly responsible for non-correlation and diversification. The Strategies that fall into this asset class are Long/Short funds, Absolute Return funds and Private Equity funds.

Second, the assets that are supposed to perform according to PERM’s investment philosophy did not do so last year. According to PERM, last year can be characterized as low growth and low inflation. So the stocks should have done poorly and they did; as well, gold/silver, which did not. On the flip side, both short- and long-term bonds should have done well. However, the short-term bonds did not do well, whereas long-term bonds did. If I understand this investment philosophy correctly, the fund should always hit two categories correctly, or always have a 50% batting average.

Although gold/silver did exceptionally well last year, and two of the fund’s investment classes did well, it was against the fund’s investment philosophy. In other words, the fund’s investment philosophy had only 25% winning performance.

That brings me to the third issue, which is that the two factors that PERM is modeling, growth and inflation, and their corresponding up and down directions, do not always correspond to the state of the market. In other words, the markets have more “states” than just these two. As we have seen in the past several years, at the very least we

PERM divides the world by growth and inflation:

Growth and Inflation

Whereas I think we really need to add more categories, such as volatility and correlation:

Adding Volatility and Correlation

All four asset classes that PERM uses — stocks, short-term bonds, long-term bonds, and gold/silver — would not have such ‘simple’ movements in different volatility and/or correlation environments.

To summarize, I think the fund deserves A+ for innovation and providing investors with diversified portfolio product. But only B- on current version of the investment philosophy. I am going to watch this fund and track it to see how the manager’s investment philosophy progresses and to monitor the performance with current allocation.

At the time of publication, Gurvich and Rockledge accounts held no positions in any securities mentioned.

Comments

Leave a Reply

You must be logged in to post a comment.