Alternative Investments Hit the Mainstream

Goldman Sachs says, “We believe the world has changed over the past decade, challenging participants’ ability to stay on track and achieve retirement goals.” This is the headline of Goldman’s recent advertisement promoting alternative investments for defined contribution retirement plans.

Now if Goldman Sachs is promoting this, it means that this is either the height of the bubble for alternative investments or the beginning of an avalanche of funds flowing into alternative strategies. Which is it?

I did not have to wait long for an answer. The day after I read Goldman’s advertisement, I got an email from Larry Fink, the chairman and CEO of BlackRock, titled “New World.” The email listed “Five Practical Actions for a More Dynamic, Diverse Portfolio,” and the third step touts you to “Open Your Eyes to Alternatives.” No, it was not a personal email from Larry to me (I am not at that level yet) but a mass email with a headline saying, “All around us, the world of investing has shifted dramatically.”

Wow, so if Goldman Sachs says it, the world must listen, and if BlackRock confirms it, then it must be true. I am generally quite skeptical about these headlines, since I have been writing about the benefits of alternative strategies for over a year now. And my firm, Rockledge, has successfully managed alternative strategies for more than half a decade. So I must admit, when I see these statements, it is music to my ears, because the big guns such as Goldman and BlackRock are coming around full blast to promote the benefits of adding alternative strategies to your investment portfolio.

Here is why it makes complete sense. By definition, alternative strategies can be of different sorts: commodities, private equity, real estate and long-short portfolios. What all these strategies have in common is that they are typically non-correlated to the broad equity indices. According to the portfolio theory and real practices, non-correlated assets provide portfolio diversification, lower volatility and decreased risk, with an overall effect of providing better risk-adjusted returns.

Look at these charts.

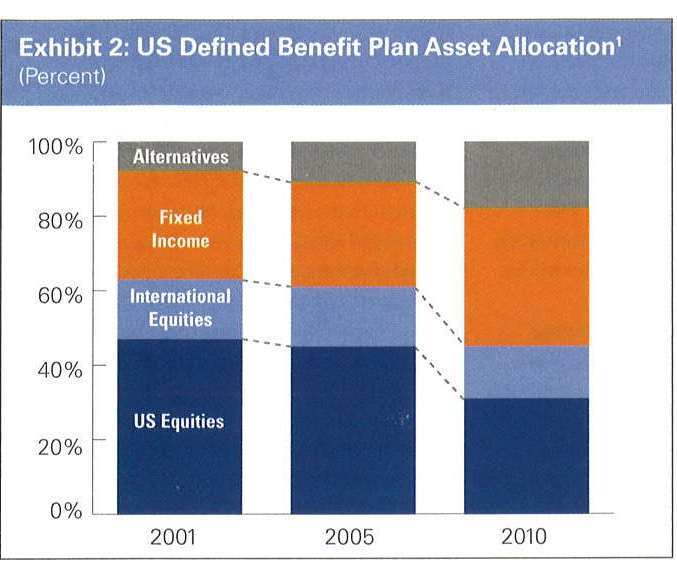

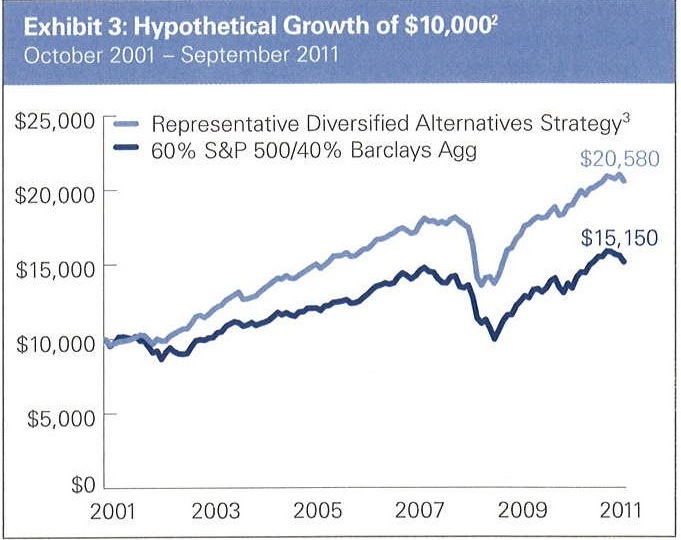

To illustrate the point, Goldman aggregated two hypothetical portfolios. One is the typical 60% equity and 40% fixed income, while the other is a more diversified portfolio that starts with about 5% allocation to alternative assets and increases that allocation over 10 years to about 20%. It is pretty clear that during periods of high volatility and high correlations over the past decade, the returns of the representative diversified alternative strategy are far superior to those of the standard 60/40 portfolio. The annualized return for the alternative portfolio is 7.4%, vs. the standard portfolio’s 4.2%. And although I do not have monthly data from the chart to calculate volatility and thus risk-adjusted return, the graph suggests similar volatility and correlation, thus implying better risk-adjusted returns.

As Larry Fink wisely notes, “Alternative investments, such as long-short strategies, commodities and real estate — now widely accessible through mutual funds and ETFs — offer the potential for diversification, enhanced performance, yield and risk management.” I could not agree more.

Although there are mutual funds that provide access to alternative assets, a clear preference would be for a similar ETF, if available, because of ETFs’ lower cost, transparency and liquidity. Some examples could be the long-short ETFs such as the Accuvest Global Long Short ETF (AGLS), the ProShares RAFI Long Short ETF (RALS) or Rockledge SectorSAM ETF (SSAM), or the six technical long-short ETFs from QuantShares: CHEP, QLT, SIZ, BTAH, BTAL, MOM and NOMO.

And if you have the stomach and the taste for “extreme” diversification with an ETF that is negatively correlated to the broad equity indices, I would suggest looking into the short-only AdvisorShares Active Bear ETF (HDGE).

__

Rockledge is a portfolio manager of the AdvisorShares Rockledge SectorSAM ETF Fund (NYSE: SSAM). Gurvich and Rockledge clients have long positions in SSAM.

Comments

Leave a Reply

You must be logged in to post a comment.