Curb Your Worries

The market has dropped like a rock since Feb. 29, with the S&P 500 falling 1.42%, and it feels as though there is more room to go. Should we panic? Is this a beginning of the new “risk-off” period?

The beginning of the year was stellar — the “January effect” rolled into some kind of February effect, and the S&P 500 gained an incredible 8.59% for both months. But it seems that, from the last day of February, the markets started misbehaving. For March, the S&P has declined 0.96% so far. Not only the fear is back since the Fed’s testimony, but there’s another big story in China’s projected growth numbers.

Let’s look at the numbers and compare economic-sector performance for two periods: the first two months of the year and March (so far).

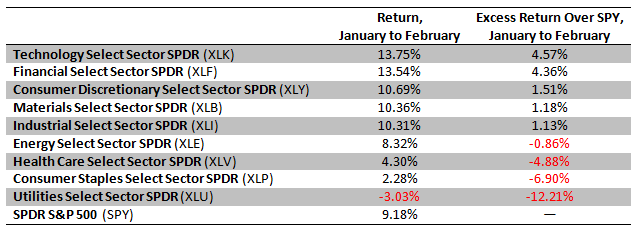

First, January and February, through sector ETFs:

Sector Performance — February and January

If I did not know what had transpired over the last couple of years, by these numbers I would say that we are in the middle of a robust growth, strong economy and rising stock market. Just look at the top-performing sectors and their excess return magnitude — technology, financials, discretionary, materials and industrials, via Technology Select Sector SPDR (XLK), Financial Select Sector SPDR (XLF), Consumer Discretionary Select Sector SPDR (XLY) and Materials Select Sector SPDR (XLB). According to the economic, business and market cycles theory, this indicates the U.S. market is somewhere between early recovery and middle recovery.

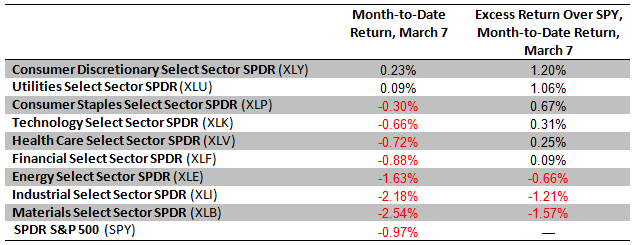

It’s quite different from the performance for this month, as of March 7:

What this indicates is the fear and recession markets: All top-performing sectors, except for the technology sector, are of a defensive nature.

So, back to the original question: Should we panic? I do not believe so.

First of all, most economic indicators show that the U.S. economy turned the corner, and that it’s starting to grow or at least starting to show some signs of growth. Second, the China effect on global growth is significant, but it is already priced in the market, and third, our SectorSAM analysis tells us that Materials and Energy sectors are expected to outperform the market. When that happens, it’s a sign of modest growth and/or recovery.

Allow me to elaborate on the first point. I do not believe we are anywhere near a raging or even a sustainable bull market, as the economy is quite fragile and susceptible to any number of shocks, whether it’s new regulations from Washington, turmoil in the Middle East or emerging-markets issues. That said, it is our belief that the U.S. economy has started moving into the first phases of the recovery cycle — which means sectors such as technology, industrials, materials and energy will start outperforming.

As for my second point about China: Yes, growth is slowing down in that country and, yes, it will likely keep slowing down over the next several years. Such rates are simply unsustainable in an export-driven economy that just faced a dampened demand from the U.S. and near-term recession in Europe. The change in direction is very important, but 7% gross domestic product growth is still a very significant number. Just compare it to the historical U.S. GDP growth rate of 3.28%.

The third point is that Rockledge Sector Scoring and Allocation Methodology is beginning to show future outperformance of the growth sectors such as energy, industrials and materials, which signify early economic recovery. It is not a large jump, and we don’t expect it to be a significant upside — but the direction is definitely there, and that’s what is most important as far as these economic growth signals are concerned.

So, again, don’t panic. Stay the course, and start planning increased allocation to equities and to growth sectors.

__

At the time of publication, Gurvich and Rockledge clients were long XLB, XLE, XLF, XLK. They were short SPY, XLI, XLP, XLU, XLV, XLY.

Leave a Reply

You must be logged in to post a comment.