A Salute to One Trailblazing ETF

In the active ETF world, we’ve just hit a major milestone — IQ Hedge Multi-Strategy Tracker ETF (QAI) is now three years old. Although there is no front-page Wall Street Journal article on this, and while CNBC did not pop champagne, I am nonetheless very excited and I believe it is a major achievement — both for the ETF industry in general and active ETF space in particular.

The reason why this is ETF is so important is that it’s an excellent example of innovation in ETFs and unique funds, as well as the fact that it brought an actively managed ETF to the market. The strategy that QAI provides is exactly what has never been available to the general investment public, which is the liquid alternative strategy.

The active ETF market is still very young –just barely over three years old. There are just over 40 funds available as of now. But the tremendous innovation of the active ETF product is becoming to be very well received by the investor community.

The fund has just under $200 million in assets and its expense ratio is 0.71%. According to the company, QAI is designed to give investors access to institutional quality investment strategies in a low cost, fully transparent, and highly liquid vehicle. It seeks to replicate the returns of the IQ Hedge Multi-Strategy Index (before fees and expenses, of course), which uses multiple hedge fund investment styles, including long/short equity, global macro, market neutral, event-driven, fixed income arbitrage and investments in emerging markets.

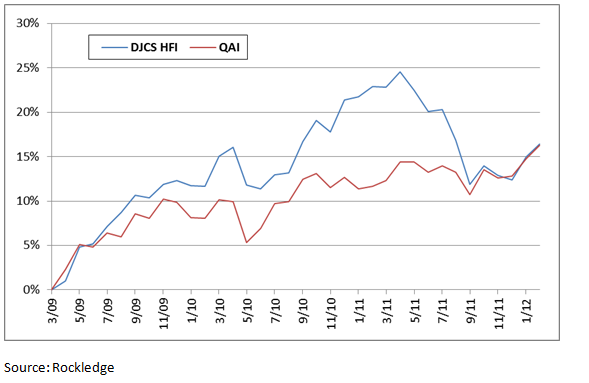

A good benchmark for comparison is the Dow Jones Credit Suisse Core Hedge Fund Index

QAI vs. DJCS HFI

The index’s performance, as you can see, are consistent with that of this major hedge fund index. Although QAI tracks a different hedge fund index, this similarity is good to see. It underperformed in the middle of this nearly three-year period, but brought virtually identical annualized overall returns — 5.3% for QAI vs. 5.4% for DJCS HFI. The interesting point is that the fund was much more stable and less volatile than the index itself, as you can see on the chart, and provided slightly better risk-adjusted returns: 0.97 for QAI vs. 0.83 for DJCS HFI. The fund adheres well to its basic investment premise, which is what we want in an investment vehicle.

The trump card of this fund is the type of strategy it offers: a hedge fund replication strategy. A typical hedge fund charges 2% management fee and 20% performance fee, and they are also illiquid, because it takes time to get your money out (as I discussed earlier this month). So here we have QAI, which provides similar hedge fund returns, is very liquid because it trades like a stock in real time and is very inexpensive relative to actual hedge funds fees. In addition to this, now that QAI has hit the three-year mark, it should earn the coveted three-star Morningstar rating.

On top of all this, the fund offers an alternative strategy that fits perfectly well in that allocation bucket of the famous endowment investment model. A typical endowment allocates around 25% of alternative strategies to its asset allocation, and this isn’t hard to understand why when you look at the last two years of performance of the QAI vs. the S&P 500.

QAI vs. S&P 500

Clearly the S&P 500 has vastly outperformed QAI during that period. However, what’s more relevant here is that QAI delivered consistent and stable monthly cash-like returns with one-third of the volatility of the S&P 500. The endowment model calls for asset diversification using alternative strategies — those with low volatility and low correlation to broad market indices — as well as equities, bonds and real assets, with the goal of obtaining better risk-adjusted returns.

There aren’t many other active ETFs that provide alternative strategies, and I manage one of them. However, I want to give respect to QAI and its issuer on pure trailblazing merits.

__

At the time of publication, Gurvich and Rockledge clients had no positions in the securities mentioned.

Comments

Leave a Reply

You must be logged in to post a comment.