Sector Rotation is Your Friend

We all have our favorite pair of jeans or a favorite sweater. We all have our favorite chair where we like to sit down and read or just simply lounge around. We always go back to that chair in the house, we jealously guard it from potential “intruders”. Why that particular pair of Levi’s? Why is that sweater so special? Why is that chair so relaxing? Well if you ask me, that pair of jeans makes me look sexier and that sweater makes me look taller and that chair feels very comfortable and cozy.

And same applies to that good old investment technique called sector rotation. But if you ask any  financial expert what is sector rotation, they will probably yawn and bat it away like a fly. They will probably tell you it is old, it is not used that often, the financial world has developed and moved beyond it and that there are better ways to invest your money. They would rather talk about High Frequency Trading, they would rather talk about how you should be happy that the tax cuts got extended, they would rather talk of anything else. If you press them about it, just try it, they will finally say something like “yeah, it’s important, but it’s old school”.

I beg to differ. Sector rotation is like that crisp, well pressed white shirt from Brooks Brothers, it is like that ten year old pair of Alden’s shell cordovan shoes – it always looks good, it goes with everything and it never, ever, ever goes out of style! An investment equivalent would be – it always works, you can always make money and it never, ever, ever goes away, the alpha is always there.

Yes, I am not talking about buy and hold, but actively participating in the markets using sector ETFs. In my previous articles I talked about asset allocation and sector investing, now I want to take it to the next level and discuss active sector rotation. Sector rotation is a natural extension of asset allocation theory, except in this case you are much more active and more aggressive in your picks.

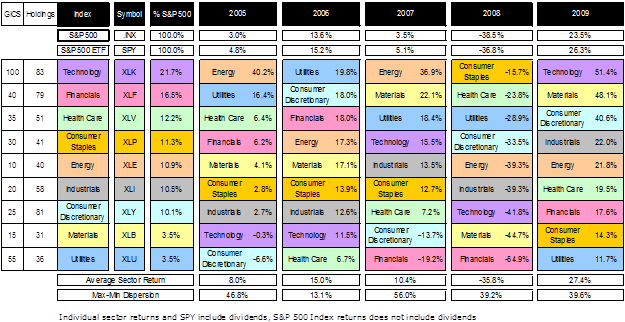

Let’s take a look at the S&P 500, it is divided into ten economic sectors, represented by Global Industry Classification Standard (GICS). Each one of these economic sectors is represented by an ETF provided by State Street, iShares and Vanguard. The most liquid ones are from State Street: Consumer Discretionary (XLY), Consumer Staples (XLP), Energy (XLE), Financials (XLF), Health Care (XLV), Industrials (XLI), Materials (XLB), Technology (XLK), Telecommunications (combined into XLK), Utilities (XLU).

If you look at the chart below, each year brings us a wide dispersion of sectors and their absolute and relative performance to S&P 500 over the past five years (2010 excluded).

Comments

Leave a Reply

You must be logged in to post a comment.