Sectors investing and why you should love it

Sector investing is a fundamental part of the classic asset allocation theory. If you are a prudent investor, who understands risk vs. reward tradeoff, you should look into sector investing, in fact I suggest you start investing in sectors vs. individual stocks. Holding a position in a sector provides inherent diversification and it reduces individual company risk. The bottom line is that investing in sectors provides better risk reward profile than investing in individual stocks.

Let’s just say your financial analytical skills were at peak last month (November) and because of your thorough analysis your crystal ball told you that financial firms would do well in December. Well, that would have been a top notch call, the financial sector (represented by XLF) is up 9.75% for the month vs. S&P 500 being up 6.00% (represented by SPY) as of 12/23/10, which is a whopping 62.5% excess return over the benchmark. So the call was excellent, the financial sector was the highest performing sector as of today, but how would you play it?

The S&P 500 Financial Sector consists of 81 companies, which one is the one? Which one will get you that winning smile at the end of the month? Do you dare to put your entire position into one company, or maybe you should buy two, well now you got to think, but wait, maybe three would make more sense? This is getting harder.

I know that Financials will do well, but do I buy 81 companies or maybe several largest capitalization companies form the sector?

To make matters even more complicated, the Financial Sector consists of four Industry Groups (subsectors): Banks, Diversified Financials, Insurance, Real Estate. Ouch, where do I go now? From which Industry Group do I pick my stocks?

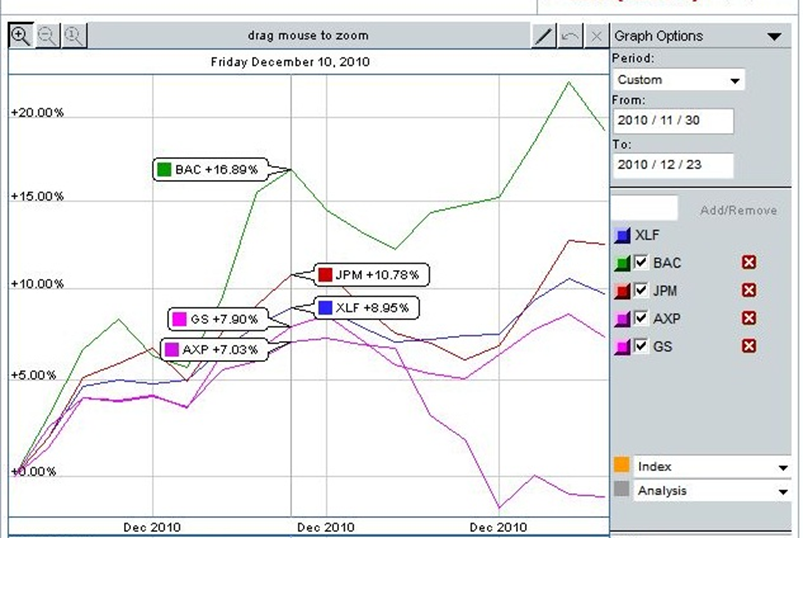

The chart below shows some companies from the financial sector, AXP, BAC, GS and JPM , compared to XLF. Some are above the overall sector and some are below, which is what you would expect.

You see where I am going with this, pretty obvious now and that is – just buy the XLF.

Much academic research and my company’s own research as well, have shown that sectors contribute up to 95% of any individual stock return. Meaning that that extra 5% or so comes very dearly with a high degree of risk.

If I want to take this a bit further, I can compare the financial sector ETF to its Industry Groups represented by IAK, IAT, ICF, KBE.

The banks (KBE, IAT) did well, outperforming XLF, while insurance (IAK) and real estate (ICF) did poorly, underperforming XLF. Once again, if you believe that a certain part of economy, as represented by a sector has a compelling story, why go for that extra 5 expensive and risky percent, just claim your glory with 95% return, while being able to sleep at night.

Position disclaimer: out of all the ETFs mentioned here, I and client portfolios hold only XLF and SPY

Leave a Reply

You must be logged in to post a comment.